The Initial Tax Rate Isn’t “Bait”

Calhoun County voters are being asked to approve a maximum property tax rate of 40 cents on each $100 valuation of all taxable property in the district, after all allowable exemptions, to support the newly created hospital district.

The hospital intends to ask the new hospital district board for an initial tax rate of 10 cents.

The hospital may seek increases in the tax rate annually, but the elected hospital district board must approve any requested increase. They don’t have to approve it.

In addition, state law prohibits the tax rate from increasing by more than 8 percent each year so even if the board did approve an annual tax rate increase, it would take 18 years to reach the voter-approved maximum tax rate of 40 cents.

Property Tax Impact

For a property owner with property value assessed at $100,000, the property tax bill is $100 a year at 10 cents per $100 valuation.

At the maximum tax rate of 40 cents 18 years from now, the property tax bill is $400, or $33 a month.

Looking Ahead

About 60 percent of tax revenue collected will be from industrial property owners in Calhoun County, not individual homeowners. But everyone benefits from having a strong healthcare system.

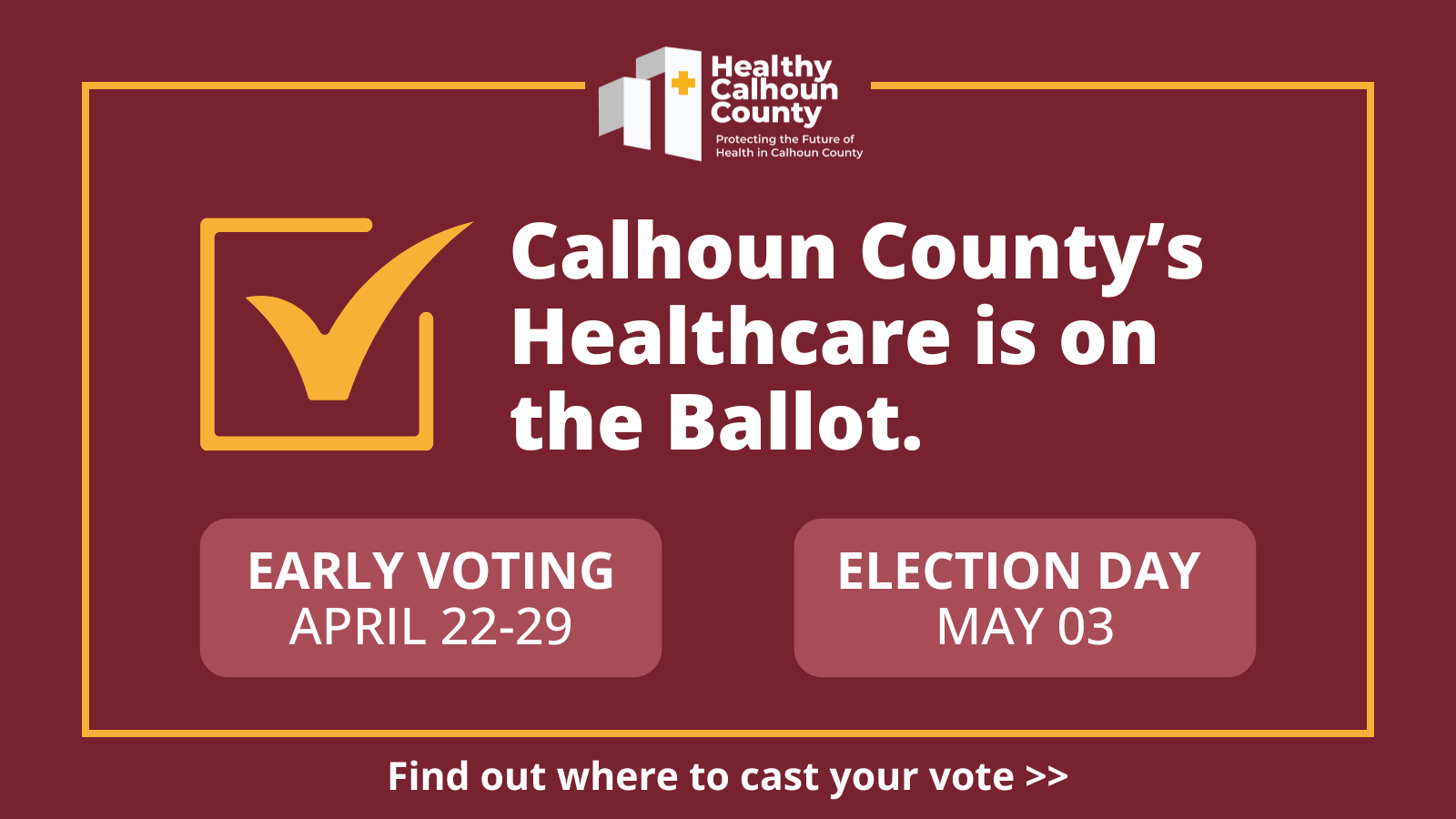

Vote yes to establish a hospital district when Early Voting begins April 22, which runs through April 29. Election Day is May 3!

More Insights and Updates

Threats of closure and fewer services continue plaguing rural hospitals

You might have caught on in previous news as rural hospitals across the state face tough decisions and weigh closing facilities. Others are looking at services where margins are narrow or negative [...]

Myth Busting! ER Transfers — When and Why?

How our Level IV Trauma Center/ER Serves our Community Memorial Medical Center is a Level IV designated trauma center, a designation awarded by the state recognizing the hospital's specialized staff, equipment, and [...]

Myth Busting! Rural hospitals under strain? Facts or Fiction?

The Financial Strain on Rural Hospitals is Real? Here's How: The financial challenges faced by rural hospitals are multifaceted. Low Medicaid reimbursement rates, rising operational costs, and staffing shortages have made it [...]